Ready for a Higher Credit Score and Bigger Opportunities?

Article Outline

Here’s the roadmap for this in‑depth guide to credit repair services:

– Introduction: Why your credit profile matters, what credit repair is (and isn’t), and how reports and scores fit together.

– What Credit Repair Services Actually Do: Step‑by‑step process, common dispute paths, and realistic outcomes.

– DIY vs. Hiring a Service: Side‑by‑side comparison of time, cost, effort, and control.

– Pricing, Legal Protections, and Red Flags: How the law safeguards you, typical fee structures, and how to vet providers.

– Timelines, Measurable Outcomes, and Alternatives: What progress looks like, sustainable score building, and proven non‑repair options.

– Conclusion: A clear, practical decision path tailored to your goals and constraints.

Introduction: Why Credit Repair Services Matter—and How to Think About Them

Credit is more than a number; it is a decision‑making shortcut for lenders, landlords, insurers, and sometimes employers. A stronger profile can mean lower borrowing costs, easier approvals, and a wider range of choices. That’s why the idea of “credit repair” is so appealing. But clarity is essential: credit repair is not a magic eraser. Accurate negative information generally cannot be legally removed before its allowed time limit. What repair can do—when done properly—is identify errors, trigger investigations, correct documentation, and help you present a more accurate picture of your financial history.

Here’s the terrain you’re navigating. A credit report is a collection of tradelines, inquiries, and public‑record items compiled by the three nationwide credit bureaus. Widely used scoring models transform that raw data into a score by emphasizing payment history and how much of your available credit you’re using, while also considering factors like the age of accounts, the mix of credit types, and recent activity. When the report contains inaccuracies—misreported late payments, mixed files, duplicate collections, or debts that should have aged off—your score can be lower than it should be. Federal law gives you the right to dispute errors for free, and the bureaus generally must investigate within a set period, often around 30 days, with extensions in some cases.

Understanding timelines also reduces anxiety. Most late payments and collections can remain up to seven years, certain bankruptcies can appear for up to ten years, and hard inquiries typically influence your profile for about two years. Knowing these clocks prevents unrealistic expectations and helps you focus on actions that matter now: paying on time, lowering balances relative to limits, and addressing errors. Credit repair services can add structure and persistence to that process. The key is to approach them like you would any professional service—by evaluating scope, pricing, compliance with consumer‑protection laws, and whether the benefits outweigh the costs compared with a do‑it‑yourself approach.

What Credit Repair Services Actually Do: Process, Tools, and Practical Limits

Legitimate credit repair services operate like project managers for your credit reports. They start with onboarding: obtaining your written authorization, collecting identification to verify you, and retrieving your credit reports from the three nationwide bureaus. Next comes a detailed audit. Specialists look for data mismatches (wrong balances, incorrect dates, unfamiliar accounts), duplication (a paid collection reported twice), status errors (an account paid in full still showing as delinquent), and items that may be outdated under federal reporting timelines. They also note issues you can’t remove but can mitigate over time—high utilization, sparse credit history, or a pattern of recent delinquencies.

Dispute strategy is the heart of the service. Providers draft targeted dispute letters and submit them to data furnishers and the bureaus, referencing your rights under the Fair Credit Reporting Act. When third‑party collectors are involved, they may also request validation under federal debt collection law to ensure the debt is documented correctly and tied to you. Supporting documentation—payment receipts, settlement confirmations, identity theft affidavits, police reports, or correction letters from creditors—strengthens your case. Throughout, reputable services track investigation windows (commonly 30 to 45 days), follow up on incomplete responses, and escalate when new evidence appears.

It’s critical to understand the boundary lines:

– Accurate, verifiable negative information usually stays until it ages off. No legitimate service can guarantee removal.

– Deletions can occur when the furnisher cannot verify the item within the timeline or confirms an error.

– Not all score increases come from deletions; some come from updates (e.g., a balance corrected downward) or from actions you take (e.g., reducing utilization).

Beyond disputes, many providers offer coaching. That can include guidance on building positive history, timing payments to reduce reported balances, addressing account mix over months, and avoiding actions that can temporarily depress your score. The real value proposition is organization and persistence: handling repetitive correspondence, tracking deadlines, and translating complex responses into next steps. Still, everything they do is grounded in rights you already possess for free. If you have time, patience, and a system, you can replicate most of the mechanics yourself. If your schedule is packed or your file is complex—say, identity theft with multiple intertwined errors—outsourcing may be worth the cost.

DIY vs. Hiring a Credit Repair Service: A Clear, Candid Comparison

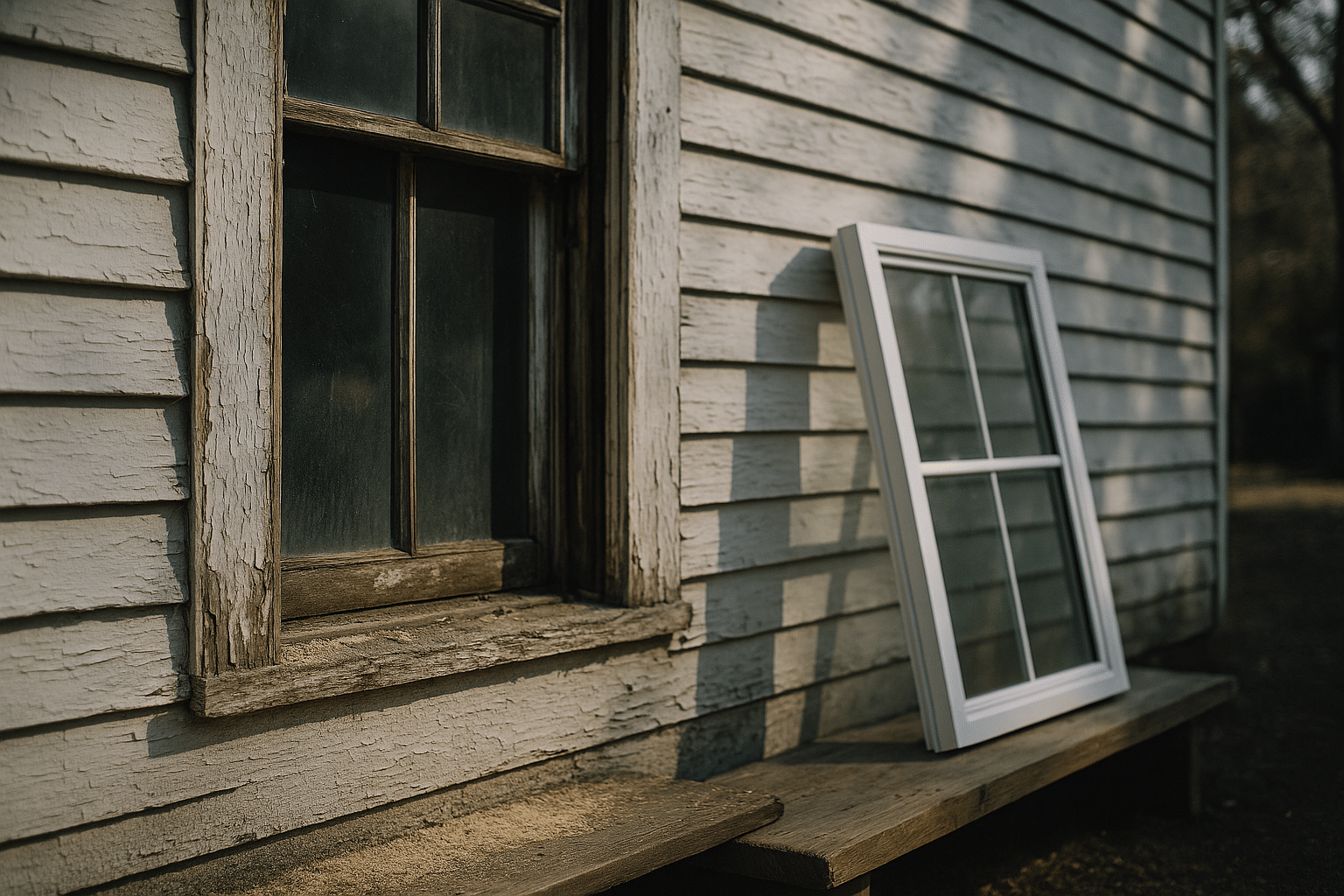

Choosing between a do‑it‑yourself plan and a paid service is like deciding whether to fix a leaky roof alone or hire a contractor. Both can work; the right choice depends on time, skill, risk tolerance, and the complexity of the job. Here’s a practical way to compare.

DIY strengths:

– Cost control: Disputing errors with the bureaus is free.

– Total visibility: You see every response and document, in context.

– Skill‑building: You learn the system, which helps prevent future missteps.

DIY challenges:

– Time intensity: Gathering documentation, drafting letters, and tracking deadlines takes steady attention.

– Learning curve: Understanding account codes, furnishers’ obligations, and legal timelines can be daunting at first.

– Emotional bandwidth: Managing disputes after past financial stress can feel draining.

Hiring strengths:

– Structured workflow: Providers have templates, tracking systems, and escalation playbooks.

– Accountability: A dedicated team follows timelines, which reduces missed opportunities.

– Guidance: Many offer coaching on utilization, account mix, and payment timing.

Hiring challenges:

– Ongoing fees: Monthly subscriptions and setup charges add up.

– Variable quality: Results depend on a provider’s ethics and process discipline.

– Indirect effort still required: You must supply documents, answer identity questions, and sometimes call creditors.

When to favor DIY:

– You have a handful of clearly documented errors.

– You can block out a few hours each month for 3–6 months.

– You prefer to keep tight control of sensitive information.

When to consider a service:

– Your reports show multiple intertwined mistakes or ID theft indicators.

– You’ve tried disputing and ran into confusing responses or repeated reinsertions of errors.

– You value time savings more than the monthly cost.

Either route benefits from a simple system: a folder or cloud drive for documents, a calendar for dispute deadlines, and a log of all calls and letters. Think like a project manager—define the issues, gather evidence, execute the plan, measure outcomes, and adjust. Whether you steer the ship yourself or hire a navigator, steady progress beats quick fixes every time.

Pricing, Legal Protections, and Red Flags: How to Vet a Provider Before You Pay

Consumer‑protection laws set guardrails for credit repair. The Credit Repair Organizations Act (CROA) requires written contracts that spell out services, fees, timelines, and your right to cancel within three business days. It prohibits misleading claims and bans demanding payment before services are performed. State laws may add licensing, bonding, or additional disclosures. Reputable providers embrace these rules; they build trust and reduce misunderstandings.

Common pricing models:

– Monthly subscription: A flat fee that covers a set volume of work and ongoing disputes.

– Per‑item or per‑round: Fees tied to the number of disputes or deletions (be cautious; incentives can become misaligned).

– Setup or audit fee: An initial charge to analyze reports and design a plan.

What’s reasonable varies by market and complexity, but you should understand exactly what you’re buying. Ask for an itemized scope: which items they’ll dispute first, how many letters per cycle, how progress will be documented, and when they’ll pivot if a tactic fails. Insist on measurable checkpoints, such as confirming bureau investigations opened, recording responses received, and tracking which tradelines changed.

Watch for red flags:

– Guarantees of specific score increases or blanket promises to remove accurate negatives.

– Demands for advance payment before any work is performed.

– Advice to create a new identity, use a credit profile number, or misrepresent information (illegal and risky).

– Opaque reporting: No client portal, no written updates, and vague explanations.

– Aggressive “pay‑for‑delete” claims without disclosing that many furnishers refuse and that outcomes can be inconsistent.

Know the alternatives to ensure you’re choosing the right tool:

– Nonprofit credit counseling can help with budgeting and debt‑management plans that may reduce interest and simplify payments.

– Direct outreach to creditors can sometimes correct errors or update statuses faster, especially when you have receipts.

– Identity theft victims should consider placing fraud alerts or freezes and filing identity theft reports to trigger specialized processes.

Finally, protect yourself on data security. You will share sensitive documents—photo ID, account statements, and correspondence. Confirm encryption practices, data retention policies, and how they verify your identity. A provider that communicates clearly, documents everything, and respects boundaries is more likely to deliver steady, compliant progress.

Timelines, Measurable Outcomes, and Alternatives That Strengthen Your Score

Progress in credit repair is often steady rather than dramatic. The first 30 to 60 days usually involve gathering documents, sending initial disputes, and receiving investigation notices. From there, cycles of 30 to 45 days repeat as items are verified, corrected, or deleted. A light‑to‑moderate error load may see meaningful report clean‑up within three to six months. Complex cases—mixed files, multiple collection transfers, or identity theft—can stretch to a year or more. The key is to set expectations you can track.

Practical metrics:

– Dispute cadence: Number of items sent and acknowledged per cycle.

– Response quality: Whether responses include itemized verification or generic form letters.

– Net changes: Count of corrections, deletions, and updates across all three bureaus.

– Score trend: Rolling average across two or three months, not single‑day swings.

Alongside disputes, build positive momentum:

– Payment history: Automate at least the minimum on every account to avoid fresh late payments.

– Utilization: Aim to keep reported balances low relative to limits; mid‑cycle payments can reduce reported figures.

– Account mix: If your file is thin, consider a secured card or a credit‑builder loan; pay on time and let age accumulate.

– Authorized user strategy: Joining a well‑managed, older account can help some profiles, but ensure low utilization and perfect payment history on that line.

Alternatives and complements:

– Nonprofit credit counseling: If high interest and multiple bills are the core issue, a structured plan can stabilize payments and reduce stress.

– Debt negotiation: Carefully weigh tax implications and potential score impacts; document every agreement.

– Identity protection: If fraud is suspected, place alerts or freezes and file the appropriate reports to access specialized remediation pathways.

– Budget and emergency fund: A small cash buffer reduces the chance of missing payments when life throws a curveball.

Think of your credit as a garden: disputes pull the weeds, but on‑time payments, low balances, and aging accounts are the sunlight and water. Over a handful of seasons, consistency produces a healthier landscape. Whether you do the work yourself or hire a guide, success comes from lawful tactics, good documentation, and habits that let your profile steadily improve long after the disputes are done.

Conclusion: Choose Wisely, Act Consistently, and Measure What Matters

Credit repair services can add structure, expertise, and time savings to a process you’re legally entitled to pursue on your own. If you decide to hire help, choose a provider that follows the law, explains its plan in writing, and commits to measurable checkpoints rather than glittering guarantees. If you go DIY, set a simple system: calendar reminders, a document folder, and a log of every letter and response. In either case, combine dispute work with habits that matter most to scoring models—on‑time payments and low utilization—so gains are both legitimate and durable. The path forward isn’t flashy, but it is reliable: know your rights, verify the data, and build better patterns month by month.